Robertet's Capital Markets Day: From Grasse Roots to a Billion-Euro Bouquet

Notes from a pleasant visit to Côte d'Azur for Robertet's first Investors Day

I. Introduction: The Scent of Change (and New Money)

Robertet, the Grasse-based purveyor of all things fragrant and flavorful, recently rolled out the red carpet (or perhaps a carpet of rose petals) for its Capital Markets Day on May 26, 2025. The event started with a breakfast in rose fields1 followed by the main presentations held at the chic Villa Blu – Robertet's own startup accelerator – and ended with factory visit. This wasn't just a casual get-together to sniff the latest concoctions. Oh no, this was serious business, underscored by a significant shift in the company's capital structure. With a newly minted ~40% free float and the arrival of some rather noteworthy investors, Peugeot Invest (PIA) and Fonds Stratégique de Participations (FSP), Robertet is clearly looking to perfume the portfolios of a wider investor base.

For a company that's been family-controlled for 175 years, this opening of the shareholder register is akin to a venerable perfumer deciding to launch a TikTok channel. The Maubert family, still very much in the driver's seat, is now sharing the ride with institutional players who likely expect more than just a pleasant olfactory experience. This CMD, therefore, was Robertet's chance to lay out its "Seed to Success 2030" strategic plan, essentially its recipe for blooming into an even bigger, more global, and, crucially, more valuable entity. So, let's uncork this story and see if the notes are harmonious (pun intended).

II. Robertet's DNA: More Than Just Pretty Flowers

At the heart of Robertet lies its Seed to Scent model, a philosophy that emphasizes full traceability and vertical integration, from the humble seed all the way to the final, exquisite fragrance or flavor. This isn't just marketing fluff; it’s a core operational principle that allows Robertet to ensure quality, agility, and a steady hand on its supply chain. Think of it as farm-to-table, but for your nose and taste buds. The company sources over 1,600 natural raw materials from more than 60 countries, boasting a staggering catalogue of over 10,000 references, with a core "Codebook" of 800 natural ingredients – a palette they claim is three to four times larger than competitors. This sheer breadth is a significant competitive advantage; while rivals might focus on a few blockbuster naturals like vanilla or patchouli, trying to compete with Robertet across its entire spectrum of 800 core naturals would be an exercise in extreme botanical whack-a-mole.

This extensive portfolio directly enables Robertet to offer highly customized solutions, a key factor in attracting and retaining clients, particularly the 11% of their clientele identified as "rising stars" – often family-owned, innovative brands seeking differentiation. These smaller, agile companies thrive on uniqueness, and Robertet's vast library of natural ingredients allows its perfumers and flavorists to craft truly bespoke creations that help these brands stand out.

A prime example of their deep entrenchment in key naturals is their position in roses. Robertet commands a 25-35% market share, making them number one in Grasse and Turkey, with a significant 80 to 90% of this supply secured under long-term contracts. This not only provides revenue visibility but also underscores their control over a critical, high-value ingredient. Their history with roses dates back to 1850, and they continue to invest in sourcing from key regions like Turkey and Bulgaria. Such deep roots in essential ingredients provide stability, but also concentrate risk if a specific crop faces systemic challenges. This makes their diversification efforts and Agritech initiatives even more vital.

Sustainability isn't just a buzzword at Robertet; it's woven into the fabric of their Seed to Scent model. As of December 2024, 64 of their supply chains, covering 150 products, were verified or certified. Their 2030 sustainability roadmap is comprehensive, addressing sourcing, transformation, and innovation.

The Seed to Scent model, while a source of immense strength in terms of quality control, traceability, and access to unique natural ingredients, also presents a fundamental vulnerability. This deep reliance on agricultural products sourced from 60 diverse countries inherently magnifies exposure to the whims of climate change and geopolitical instability, which can wreak havoc on supply chains and pricing. One subtle but important aspect of their sustainability narrative is the relatively limited land requirement for their crops compared to food production.

II. "Seed to Success 2030": Can They Grow a Billion-Euro Behemoth?

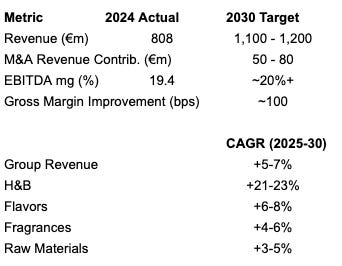

Robertet isn't just aiming to smell nice; they're aiming for a pretty hefty financial glow-up. The Seed to Success 2030 plan, unveiled at the CMD, sets a target of €1.1 to €1.2 billion in sales by 2030. This translates to an average annual growth rate of 5-7%, a pace designed to outstrip the broader flavors and fragrances (F&F) market. Alongside this top-line ambition, they're targeting a 100 basis point improvement in gross margin, contributing to an EBITDA margin of approximately 20% or more by the decade's end. The levers for this margin expansion include the usual suspects: price increases (easier on new, differentiated products), a more globalized and vertically integrated supply chain, and efficiencies in indirect costs.

The growth strategy rests on several pillars:

Organic Expansion: This forms the foundation, driven by consolidating their core business and launching new initiatives. It's expected to deliver 80% of the targeted 10% CAGR in new markets.

Asian Acceleration: Asia is clearly marked as a key growth engine. The goal is to increase Asia's contribution to revenue from 16% in 2024 to 22% by 2030, fueled by an impressive +11-13% CAGR. This involves significant production expansion: a new plant in Indonesia (set to be operational in 2025) and a tripling of production capacity in India.

Health & Beauty (H&B) Surge: The H&B division, currently a smaller contributor at 3% of 2024 sales (€24 million), is slated for "accelerated growth". The target is a blistering +21-23% CAGR, aiming to make it 6% of total sales by 2030 (potentially €66-72 million). This division is a hotbed for innovation, particularly focusing on "upcycled residues, made for functionality". Key areas include longevity, the concept of "skin = the 3rd brain," and predictive science. A prime example is Damasty, an antioxidant nutricosmetic derived from the upcycled co-products of Rosa Damascena extraction in Turkey.

Strategic M&A: Mergers and acquisitions are expected to chip in €50 to €80 million in revenue by 2030. The focus here is on the Flavors segment, which apparently offers more M&A opportunities. Ideal targets are profitable, long-term oriented businesses with sales in the €40-50 million range, and Robertet seems willing to pay around 2-3 times sales or 12-15x EBITDA. The 2023 acquisition of Sonarome in India serves as their "blueprint" for this strategy. While the overall revenue contribution from M&A is modest, these deals are strategically crucial for filling gaps, particularly in Flavors and accelerating the Asian expansion.

Here's a snapshot of Robertet's key 2030 ambitions:

Table 1: Robertet's "Seed to Success 2030" - Key Ambitions

III. The Balance Sheet Bouquet: Unpacking the Financials

Robertet's financial history paints a picture of steady, fragrant growth. From 2015 to 2024, revenue blossomed at a +7.1% CAGR (with organic growth contributing +5.2%), reaching €808 million in 2024. EBITDA margins have shown consistent improvement, climbing from 16.1% in the 2015-2017 period to 18.9% between 2021 and 2024, with FY2024 EBITDA hitting €157 million for a 19.4% margin. Net income has grown even faster, with an +11.2% CAGR from 2019 to 2024, landing at €90 million in 2024.

Looking ahead, the 2030 financial blueprint targets €1.1-1.2 billion in revenue and an EBITDA margin of around 20% or slightly more. However, the company candidly notes that its natural model sets structural limit on gross margin improvements, an acknowledgment of the inherent volatility and cost structures associated with natural raw materials. This implies that significant EBITDA margin expansion will also need to come from operating leverage and rigorous control over indirect costs.

A key focus is the "working capital diet." Historically, Robertet's working capital has been on the heavier side, a consequence of its natural ingredient sourcing which necessitates holding substantial inventory. The plan is to trim working capital as a percentage of revenue from 37% in 2024 down to 33% by 2030. Strategies include better alignment of supplier and customer payment terms and optimized global inventory management. This reduction is a critical, albeit challenging, lever for achieving their projected free cash flow and overall financial robustness. Success here will unlock significant cash; failure could strain resources, especially with ambitious expansion plans in diverse geographies like Asia. The trade-off between resilience and efficiency is one of my major concerns with regards working capital optimization.

Capital expenditure is set to remain robust at approximately €40-45 million per year through 2030, representing 3-5% of revenue. These funds are primarily earmarked for industrial capacity enhancements (85%) and IT system upgrades (15%), supporting both growth and operational excellence.

This disciplined spending, coupled with margin gains and working capital efficiencies, is projected to lead to a significant bloom in free cash flow (FCF). The target for FCF (pre-M&A) by 2030 is €105-115 million. This cash generation is vital, as it will be used to fund the M&A strategy and support an increased dividend payout, targeted at 25-30% of net income.

On the debt front, Robertet has been deleveraging, with the net leverage ratio falling from 1.3x EBITDA in 2023 to a comfortable 0.7x in 2024. The company aims to maintain a net leverage ratio between 0 to 2x EBITDA from 2025 to 2030, providing ample strategic flexibility. This "disciplined financial approach" and low leverage are prerequisites for executing their M&A ambitions (€50-80 million contribution by 2030) without unduly stressing the balance sheet, especially since their target acquisitions are profitable entities likely commanding fair market multiples.

There's a subtle tension in the capital allocation plan: the ambition to increase the dividend payout to 25-30% while simultaneously funding €40-45 million in annual CAPEX and a €50-80 million M&A program by 2030.

Table 2: Robertet Financial Scorecard: Past Performance & 2030 Vision

IV. The New Shareholders on the Block: Peugeot, FSP, and the Fine Print

November 2024 marked a significant evolution in Robertet's shareholder landscape with the arrival of Peugeot Invest (PIA) and Fonds Stratégique de Participations (FSP), each acquiring a 7.1% stake. This "capital reorganization" saw DSM-firmenich largely exit its holding, thereby increasing Robertet's free float to around 40%, while the Maubert family simultaneously reinforced its own position.

Peugeot Invest, the investment arm of the Peugeot family, views Robertet as a "high-potential company" and aims to leverage its "expertise as a listed investment company" to help "enhance market recognition and valuation". Their strategy typically involves taking significant minority stakes in priority sectors, often alongside reputable partners, focusing on businesses with attractive models, profitability, and strong cash flow generation. FSP, managed by ISALT, is an alliance of seven major French insurers. Its mandate is to provide "long-term support to French companies in their growth and transition projects," which it does by acquiring "significant 'strategic' stakes" and actively participating in their governance, usually via board seats. For FSP, the Robertet investment is a clear nod to supporting "leaders in French industry".

Governance-wise, both Peugeot Invest and FSP are set to join Robertet's Board of Directors, with the Maubert family's support. A key element is the shareholder agreement between Maubert SA (the family holding company), PIA, and FSP, which constitutes an "action de concert" or concerted action. Under French regulations, this implies a degree of coordination on voting or strategic matters among these major shareholders. However, the Maubert family's control is explicitly preserved; the agreement includes provisions for PIA and FSP to "forego part of their double voting rights...to preserve Maubert SA’s majority voting rights," and they do not possess veto rights or joint control.

The structure of PIA and FSP's investment is particularly noteworthy, utilizing a combination of ordinary shares (4.9%) and investment certificates (ICs, 2.2%, also listed but with very thin liquidity). Investment certificates are a feature of French company law, often employed by family-controlled businesses to raise capital or bring in strategic partners without immediately diluting voting control. ICs typically grant economic rights, such as dividends, but have limited or no voting rights.

The real intrigue lies in the May 2030 conversion option for these ICs. From this date, Peugeot Invest and FSP can convert their ICs into ordinary shares by exchanging them for voting rights certificates (CVDs) held by Maubert SA, at an agreed ratio of 8.5 CVDs for 1 IC. This creates a potential future inflection point for Robertet's governance. Should PIA and FSP choose to convert, their voting influence could increase. However, Maubert SA has a counter-option: it can choose to acquire these ICs in cash (up to approximately 1% of capital from each investor) at their original acquisition price plus an agreed annual yield, providing the family with a mechanism to manage potential dilution of control (GG note: this option seems very likely given that PIA and FSP purchased ICs at €557, a 35% discount to ordinary shares). This 2030 timeline aligns neatly with the culmination of the "Seed to Success 2030" plan, effectively setting a long-term performance checkpoint. The company's performance over the next five years will heavily influence the attractiveness of this conversion for the investors and the Maubert family's response.

V. An Analyst's Olfactory Test: Robots, Risks, and Returns

Beyond the strategic pronouncements and financial forecasts, what does the underlying business really smell like? Robertet's flagship factory in Grasse is a testament to operational efficiency, being "95% automated" and churning out 80 tons of scents daily with a lean team of 70 people – down from 130 just a few years ago. This isn't just a local marvel; the plan is to replicate this efficiency globally, with ambitious automation targets for facilities in Mexico (over 85%), China (over 80%), and the USA (over 81%). Successfully exporting this high-automation model is crucial for achieving targeted cost efficiencies and maintaining consistent quality as Asian operations, in particular, scale up.

The anecdote about Mercadona, a major supermarket chain in Spain, switching its chocolate ingredients from synthetic to Robertet's natural alternatives at the same cost is more than just a charming story. It’s a powerful proof point. If Robertet can deliver natural ingredients that are cost-competitive with synthetics for certain applications, while also offering the "clean label" appeal consumers increasingly demand, their addressable market expands dramatically beyond premium niches into mainstream food and beverage categories. This capability is fundamental to achieving the broad-based growth outlined in the 2030 plan.

However, no investment thesis is without its potential sour notes. Robertet faces several key risks:

Raw Material Volatility – The Perennial Thorn: The company itself acknowledges "navigating gross margin volatility tied to raw material costs," and admits its "natural model sets structural limit". This dependency on agricultural products like flowers and spices exposes Robertet to the full force of climate change (which can affect crop yields and quality for key ingredients like jasmine, lavender, and vanilla), crop failures, and geopolitical disruptions that can snarl supply chains and send prices soaring. Mitigation strategies are in place – diversified sourcing across 60 countries, long-term contracts (like those for 80-90% of their rose supply), deep vertical integration via the "Seed to Scent" model, Agritech investments to build resilience, and innovation in extraction and biotechnology. This multi-pronged innovation strategy is, in itself, a fundamental risk mitigation tool, aiming to develop climate-resilient crops and unique, hard-to-replicate extracts.

The Big Competitors Sniffing Around: Giants like Givaudan, IFF, and Symrise are significantly larger and are also making substantial investments in natural ingredients and sustainability. They possess greater financial firepower for R&D and large-scale M&A. Robertet's defense lies in its profound, specialized expertise in naturals, its claim to the "widest portfolio," its agility, strong client relationships (especially with those "rising stars"), and the sheer complexity for a competitor to replicate its entire global natural sourcing network.

Execution in New Territories (Especially Asia): The ambitious growth targets for Asia hinge on successfully building and expanding production facilities (like the new Indonesian plant and the Indian scale-up), integrating acquisitions such as Sonarome, and skillfully navigating diverse local market dynamics, cultures, and regulatory environments. Mitigation involves establishing regional headquarters and local creative centers, fostering strategic partnerships, and using M&A to acquire local expertise and market access. The integration of Sonarome will be a closely watched test case.

Robertet's current valuation often appears modest compared to its larger peers. Successfully de-risking its natural supply chain through innovation and robust sourcing strategies, coupled with demonstrable success in its Asian expansion, could be key catalysts in closing this valuation gap. This aligns with one of the stated goals of bringing in Peugeot Invest – to enhance market recognition and valuation. If Robertet can prove its unique naturals-focused model is both scalable and resilient, the market may well assign it a more premium multiple.

Table 3: Robertet vs. The Big Guys: A Naturals Snapshot & Valuation Glance

VI. Final Whiffs: Is Robertet's Future Coming Up Roses (or Just Potpourri)?

So, after a day steeped in strategy and scent at Villa Blu, what's the takeaway on Robertet? The bull case is fragrant indeed: undeniable leadership in the booming "naturals" space, a well-articulated "Seed to Success 2030" plan with clear (and ambitious) financial targets, a solid history of growth and profitability, and an innovation engine designed to keep them ahead of the curve. And let's not forget the impressive operational efficiencies, like that highly automated Grasse factory that we visited, which they aim to replicate.

However, every rose has its thorns. Execution risk looms large, particularly concerning the ambitious Asian expansion and the integration of future M&A targets. The specter of raw material volatility, amplified by climate change and geopolitical uncertainties, remains a constant challenge for a company so deeply rooted in natural ingredients. Competition from much larger, well-capitalized players who are also aggressively pursuing the naturals trend cannot be discounted. Key questions remain: Can the Health & Beauty division truly scale to become a significant growth driver? Will the targeted working capital improvements materialize to fuel the desired free cash flow without compromising resilience?

The "Seed to Success 2030" plan is, in essence, Robertet's public declaration that it can scale its unique, nature-centric model without diluting its essence or stumbling over its own ambitions. The 2030 conversion option on those investment certificates held by Peugeot Invest and FSP acts as a not-so-subtle long-term performance incentive.

The company's "underpromise to overdeliver" philosophy will certainly be put to the test in the coming years. If Robertet can successfully navigate the risks, particularly by de-risking its natural supply chain through innovation and demonstrating scalable, profitable growth in its new ventures, its future could indeed be coming up roses. The alternative – a collection of interesting but ultimately sub-scale initiatives – would be mere potpourri. The journey to €1.1-1.2 billion is not just about financial targets; it's about proving that this 175-year-old Grasse institution can blossom into a truly global, modern leader in the world of natural ingredients, and perhaps, finally get the market valuation that reflects such a unique bloom.

Centifolia (hundred leaved) roses to be precise that have a very distinct smell. We talked with the field owner (which sells his full production to RBT) and also learned how to pick these roses.