My original goal is to do in-depth analysis of companies but sometimes there are market misallocations that make such analysis almost superfluous. This is one of those times.

Ibersol is a multi-brand restaurant operator in Iberia and with a small presence in Angola. It has its own brands but most of its sales come from being the franchisee of brands such as Pizza Hut, KFC, Taco-bell and, until recently, Burger King (BK). In 2022, Ibersol agreed to sell its BK restaurants for a total of €260m, and that’s what makes Ibersol a special situation: The deal just closed in the 4Q22, a lot of cash has come in and the market seems to be overlooking it.

Disclaimer: Before getting into the details, please note that this is not investment advice. I am just writing for entertainment purposes and you should ALWAYS do your own due diligence. I may or may not - but definitely do - have shares of Ibersol.

Special situation details

“You don't need to know a man's weight to know that he's fat”

(repeated often by Warren Buffett when asked how does he know when a company is cheap; originally attributed to Benjamin Graham )

Indeed one does not have to do a great deal of calculations to notice how cheap Ibersol is. I will jump straight into those.

# shares = 46m, of which own shares = 3.6m

# outstanding shares = 42.4m @ price per share of €6,30 (01/02/23) => Market cap = €267m

There is ~€40m of net debt as of Sep’22

So, EV (Enterprise Value) added up to €307m

Total consideration of €260m, of which €244.5m cash + earn-out of €15.5m, is ~85% of EV

Rest of the business is currently being valued at ~€47m and should do a net profit of ~€10m (own estimation, more on that below). That’s 4.7x earnings. Even if you exclude the earn-out you still reach an undemanding 6x valuation.

Management with skin in the game

Having management incentives aligned with shareholders’ is usually quite important; but with such a big portion of the capital to be relocated, it’s paramount.

The company is managed and controlled by two long standing friends, António Pinto Sousa (70) and Alberto Teixeira (75), who are the longest serving managers of a company listed in the main Portuguese stock index (PSI20). The duo bought Ibersol in 1997 through a management buy out partially financed by an IPO. Up until then Ibersol was part of Sonae, a large conglomerate in Portugal. On the following decades Ibersol went on to grow sales at an average rate of ~10% until the pandemic hit. Capital allocation over this period has been decent with ROIC hovering around 10-12% in good times (ie 2016-19) and at still acceptable levels of 3-7% during severe macroeconomic periods such as the European Sovereign crisis (2011-13) which was particularly acute in Iberia. As per Bloomberg, total shareholder return has been 437% since the IPO (7% annual return).

The two friends own 61% of Ibersol, worth ~€160m at current market prices. That’s >100 fold their combined salary of €1m and very likely to be the vast majority of their net worth. It’s safe to say that both Mr. Teixeira and Mr. Pinto Sousa have significant skin in the game and their interests are aligned with the remaining shareholders.

I suspect that a significant part of the cash proceeds will be distributed to shareholders while the remaining will be used to pursue sensible growth opportunities: mostly on developing KFC and Taco Bell brands as they are still underrepresented in the Iberian market.

Why does this opportunity exist?

Likely for the following reasons:

Uncertainty with regards to future cash allocation/distribution

Low stock liquidity, with limited free-float of only €22m at current prices

And, perhaps the most important one, recent financials and performance is very messy and full of both negative and positive one-offs making it hard to have a sense of the true earnings power of Ibersol

2019-22 financials are indeed quite messy. Most notably, the pandemic had a dramatic impact on Ibersol’s operations leading to a 40% decline in revenues and net losses of €55m in 2020 (its first year with losses since the 1997 IPO). The company ended up doing a capital increase of €40m in 2021 that we now know was unnecessary. Positive one-offs include government subsidies and a much needed law in Spain that has linked the minimum rents Ibersol was paying airports to passengers volumes, materially reducing them.

Even the more “normal” 2019 figures are not very representative. Ibersol has suffered from a strong hike in Spain’s minimum wages (+22%) and from Barcelona airport (BCN) concession renegotiation with closure and re-opening of counters. Ibersol had a 100% market share in BCN’s restaurants and that has shrunk to 40%. The company tried to compensate those lost sales by bidding for new restaurants in other airports in Iberia.

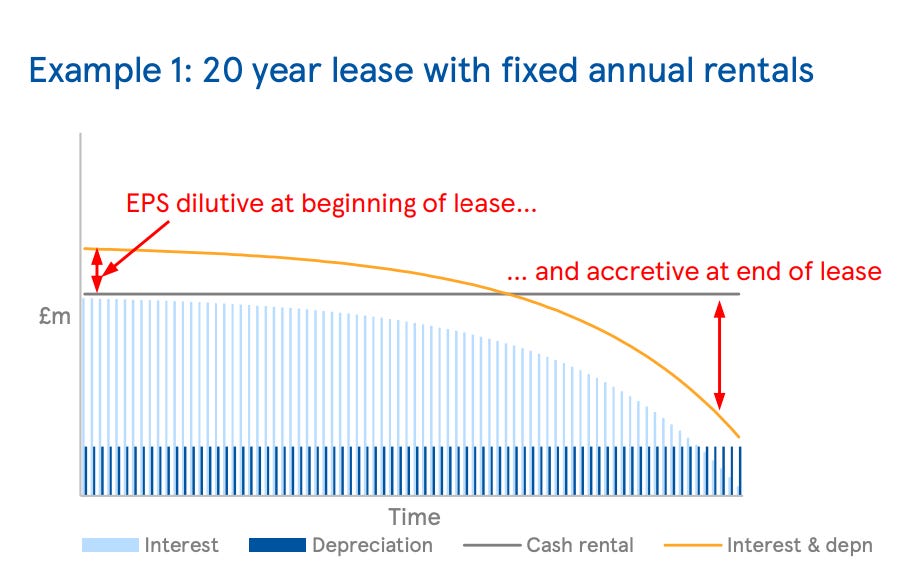

Moreover, new accounting standards IFRS 16 optically reduced 2019 earnings by 35% to €18m as most leasing contracts were on their early days and their interest component quite high.

Side note: IFRS 16 changed the way that companies account for their operational leases such as the restaurant rents. Before IFRS 16, companies booked their rents in the P&L as they pay them (rent = cash). IFRS 16 introduced some complexity by replacing the pure rent expense by an interest and depreciation components, making a lease optically more expensive at beginning and cheaper at the end (even though the economic reallity is the same).

BK (former) contribution & Ibersol’s remaining earnings power

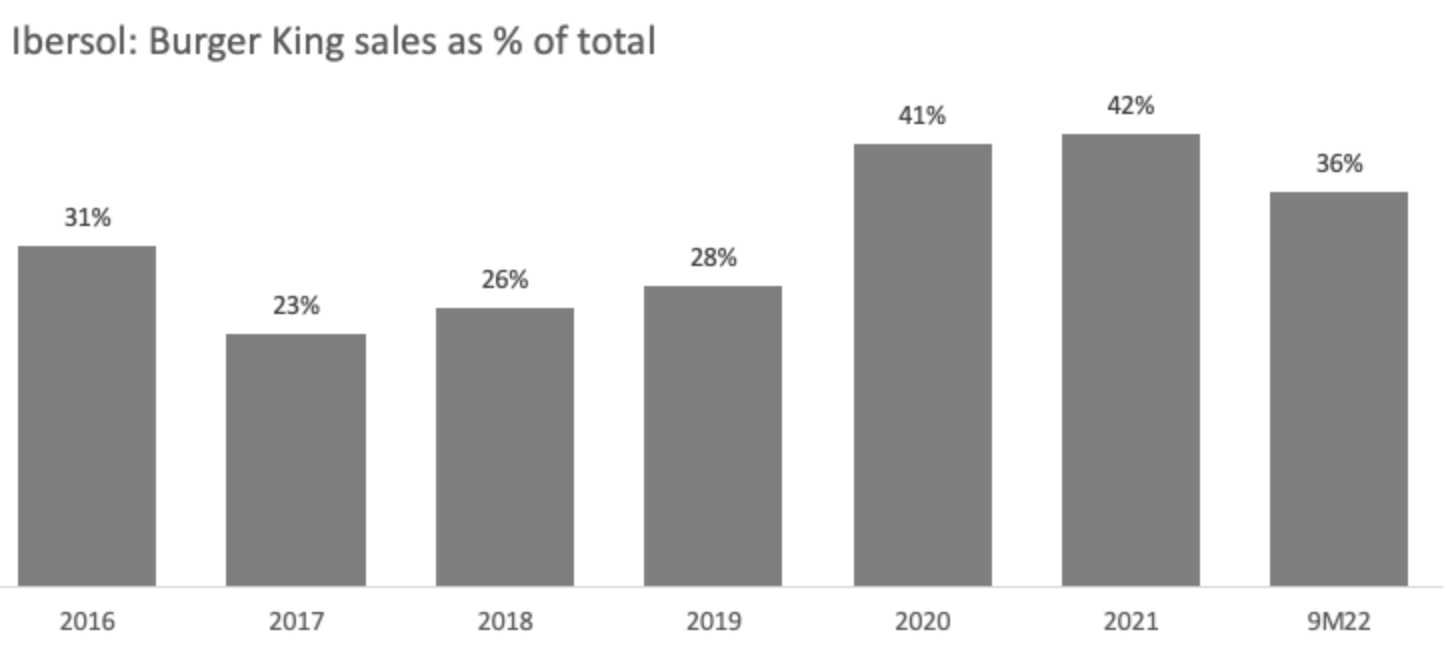

BK contribution materially increased from 28% of sales in 2019 to 42% in 2021 before easing to 36% in 9M22. The reason is twofold:

BK has been the brand under which Ibersol has been opening the most restaurants: +36 BK restaurants since 2018 to 158 in Sep’22 (25% of total restaurants), while total Ibersol restaurants actually declined by 20 to 621 over the same period

There are specific characteristics that made BK concept more resilient during the pandemic such as drive-through and counter restaurant sales (as opposed to sit-down restaurants). The remaining restaurants are catching up as the economic and movement of people normalize

Ibersol does not usually disclose its profitability by brand, but because it classified BK as discontinued operations in the 9M22 earnings report, we know the breakdown for this period only:

I estimate that the remaining business to have ~€10m of earnings power: The RemainCo generated €7.3m in 9M22 with an positive one-off of €2m from indeminizations (~€1.5m net of taxes), so let’s say it has ~€6m of “normalized” earnings generated in the 9M22. To annualize we have to keep in mind that Ibersol business is seasonal with much stronger 3Q and 4Q (in more or less equal parts) due to summer and Christmas holidays period. Ibersol made a €10,8m profit in 3Q22 alone (incl BK). If we assume that the RemainCo is able to do ~40% of that again in the 4Q, we will have an additional €4m. So there you go: €6m + €4m = €10m. And because the remaining restaurants of Ibersol have been hit harder in the pandemic, they now also have more room to recover. To put this figure into perspective, Ibersol total earnings were hovering about €18m to €31m in the pre-pandemic period when BK sales’ share were less than 30%. I think it is reasonable to expect that the RemainCo is going to do at least half of that in 2022 and 2023.

Tax considerations

Ibersol is going to book ~€160m capital gains with the sale. Most of this won’t be taxed at the company level. Capital gain taxes are tax-exempt when a holding sells a subsidiary in Portugal, whereas in Spain, generally 95% of the capital gains are tax-exempt.

However, depending on how the Ibersol decides to distribute capital, individual shareholders might be liable to pay taxes. If the Ibersol choses to return capital via dividends, the usual withholding tax in Portugal is 28% but can be as high as 35% if the account is in street name (as it happens with accounts in Interactive Brokers). It might be bureaucratic and time consuming to recover it. Hopefully, the company might opt to distribute cash via a capital reduction, in which case there is no withholding tax.

Limited moat is the main negative aspect of the investment case

I believe Ibersol does not have a strong competitive advantage as it does not own the more successful brands neither the more successful venues. Unfortunately for Ibersol, the economic value is mostly captured by franchisers and prime real estate owners.

Ibersol is, however, an OK business with OK returns on capital, aligned management, and at these prices, it is too cheap to ignore.

Ibersol was a tremendous pick for your first equity research post on substack. I would like to congratulate you on your analysis, specifically in highlighting the alignment of management and minority shareholder’s interests. I am both an Ibersol and Semapa shareholder and I hope that you in the future analyze the alignment issues present in Semapa between minority shareholders and management/Sodim.

Avid listener of your podcast and now reader of this substack!

Boas Gonçalo, venho através do All In Stocks e quero congratular-te pela iniciativa.

Boas pesquisas e investimentos!

Um grande abraço